First impressions from the market floor

Choosing among forex brokers can feel like sorting through a busy bazaar. The eye shifts from spread tightness to platform stability, and from verification speed to customer help that actually speaks plain language. A clear advantage shows when a broker lists transparent pricing with no hidden swaps and a real-time forex brokers dashboard that makes sense quickly. Prospects look closer at trade execution speed, minimal slippage, and a solid risk model. Traders search for brokers that respect a approach—where contracts for difference are treated as flexible tools, not tricky traps in disguise.

- Transparent pricing with real-time updates.

- Fast, reliable execution and clear order types.

- Accessible demo accounts to test strategies.

How trust grows when you test the water

Trust thickens when due diligence pays off. A disciplined route uses verified regulation, reputable liquidity partners, and a predictable fee layout. The best traders read the fine print about margin requirements and withdrawal policies. Even small glitches—like a delayed quote trader cfd or a hiccup while placing an order—can break confidence. A robust broker should encourage a flow that lets a trader cfd mindset breathe: hedges, stops, and scalable leverage without sudden shutdowns in volatile times.

- Regulatory status and capital adequacy checks.

- Clear fee structures including spreads and commissions.

- Responsive, multilingual support and timely withdrawals.

Tools that turn data into action

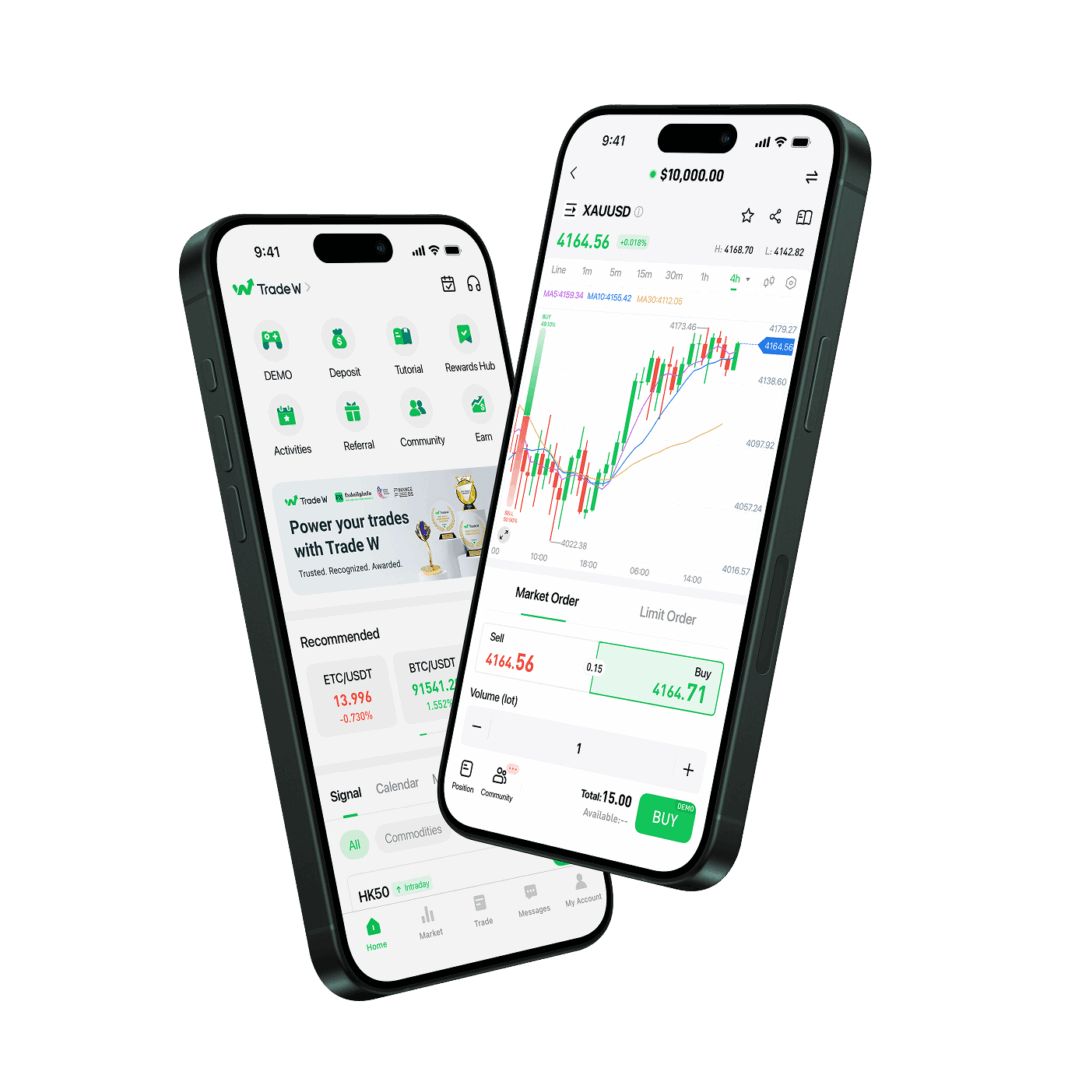

Good platforms blend charting, indicators, and a fast API with a calm, intuitive feel. When a broker offers reliable backfill data and a programmable interface, a trader cfd plan can run more smoothly. Traders look for robust order types, including conditional orders, OCO setups, and scalable risk controls. A strong ecosystem includes educational content, sample strategies, and real-world case studies that show how to adapt when news hits and liquidity dries up. The practical payoff comes in fewer guesses and more guided steps toward consistent entries.

- Advanced charting with customizable templates.

- APIs for automated trading and data export.

- Educational resources that cover risk and strategy.

Fees, deposits, and the small print that matters

Fee sanity matters as much as execution speed. Every broker charges a mix of spreads, commissions, and overnight financing. A thoughtful user analyzes total cost per trade, including rollover costs on holds. Wallet-friendly options like micro lots can help new traders. A strong platform makes it easy to compare costs across pairings and time frames. For someone embracing a trader cfd approach, it’s essential to understand how price gaps, liquidity conditions, and swap rates affect day-by-day results without pretending margins are limitless.

- Visible spreads and transparent rollover rates.

- Flexible funding methods and quick processing times.

- Cost comparisons across assets and timeframes.

Security and reliability on every trade

Security is not buzz; it’s a baseline. Reputable forex brokers employ multi-layer protection for data and funds, with segregated client accounts and regular third-party audits. A dependable broker also shows uptime metrics, disaster recovery plans, and clear disclosures about risk events. For a trader cfd path, the assurance that counterparties are well capitalized matters. When a platform feels sturdy under pressure, the mind stays focused on strategy rather than fear of a sudden lockout or data loss.

- Two-factor authentication and encrypted data transfer.

- Independent risk controls and insurance coverage details.

- Public uptime and incident reporting for transparency.

Conclusion

In the end, a solid choice comes down to a broker that keeps the gear clean: tight, consistent pricing; reliable execution; and a platform that respects a trader cfd plan while offering real, actionable insights. The path toward steady results rests on how well the broker balances speed with risk controls, and how transparently fees are shown in real dollars. For those who want a trustworthy, well-rounded partner, tradewill.com stands out as a practical reference point in a crowded field. With patient testing and careful comparison, the right match emerges, one that supports ongoing learning, disciplined risk-taking, and clear progress over time.